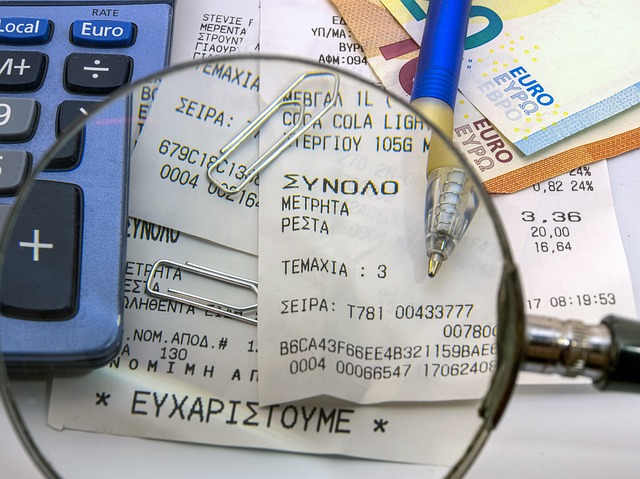

Organized financial records through structured documentation and budget planning enable efficient tax management. Analyzing profit/loss statements and staying current with tax laws facilitate informed decisions on deductions and credits. Global tax rates comparison and understanding double taxation agreements are vital for businesses with international operations. Utilizing IRS resources, like tax forms explained, and consulting professionals maximize tax savings while ensuring compliance.

Efficient tax management is essential for every individual and business owner. To streamline the process, organize your financial records by keeping detailed documentation for easy reference. Stay informed about tax laws to make smart decisions that could save you money. Budgeting and setting aside funds in advance can prevent last-minute stress. Additionally, leverage deductions to legitimately reduce your taxable income. These tips will help you navigate the complexities of taxes with ease and ensure compliance.

- Organize Financial Records: Keep Detailed Documentation for Easy Reference.

- Understand Tax Laws: Stay Informed to Make Smart Decisions.

- Set Aside Funds: Budgeting Helps Avoid Last-Minute Stress.

- Utilize Deductions: Legitimately Reduce Your Taxable Income.

Organize Financial Records: Keep Detailed Documentation for Easy Reference.

Maintaining organized financial records is a cornerstone of efficient tax management. Keeping detailed documentation allows for easy reference when preparing tax returns, which can save significant time and reduce potential errors. Organize receipts, invoices, and any other financial documents in a structured manner to ensure their accessibility throughout the year. This practice facilitates a smooth process during tax season, making it easier to gather necessary information quickly.

Comprehending your financial picture involves analyzing key documents like profit and loss statements. This analysis enables you to identify potential areas of concern or opportunities for savings through tax credits for energy efficiency, capital gains tax implications, and navigating complex tax scenarios. By keeping thorough records, individuals can better understand their financial standing and make informed decisions regarding tax planning. Additionally, if you’re curious about the impact of green taxes, find us at Green Taxes and Their Impact to explore how these taxes can influence personal and business finances.

Understand Tax Laws: Stay Informed to Make Smart Decisions.

Understanding tax laws is a cornerstone of efficient tax management. Staying informed about changes and updates to tax codes allows individuals and businesses to make smart financial decisions. For instance, knowledge of self-employment tax guide can help freelancers optimize their income and expenses, while awareness of tax advantages of retirement accounts encourages strategic planning for future financial security. By staying up-to-date, you can take advantage of legitimate tax deductions for students and other eligible expenses, potentially reducing your overall tax burden.

Regularly reviewing tax laws also helps in mitigating audit risk factors. Understanding the rules enables you to keep detailed records and maintain a transparent financial system, making it easier to justify any transactions during an audit. Moreover, being aware of various tax planning strategies allows for proactive measures to minimize tax liabilities. For a comprehensive guide, consider visiting us at Tax 101 for Students, where we offer valuable insights tailored to different situations.

Set Aside Funds: Budgeting Helps Avoid Last-Minute Stress.

Setting aside funds for taxes throughout the year is an effective strategy to avoid last-minute stress. Budgeting allows individuals and small businesses to allocate specific resources for tax obligations, ensuring a smoother financial journey. By integrating tax planning into your budget, you can accurately predict and manage expenses related to income tax, sales tax, and other relevant levies. This proactive approach enables you to take advantage of legitimate small business tax deductions and make informed decisions regarding tax preparation software.

Moreover, understanding global tax rates compared across different jurisdictions can benefit businesses with international operations or those considering expanding abroad. Additionally, being prepared for potential double taxation agreements between countries can help mitigate overlapping taxes on the same income. For a comprehensive guide, refer to IRS tax forms explained, available on their official website, which provides detailed instructions and forms for various tax scenarios.

Utilize Deductions: Legitimately Reduce Your Taxable Income.

Maximize your tax savings by taking advantage of deductions allowed under both domestic and international tax laws. Legitimate deductions can significantly reduce your taxable income, resulting in lower tax liabilities. For instance, if you’re a business owner, consider deducting legitimate business expenses such as office supplies, equipment, and travel costs.

In more complex tax scenarios, like those involving homeschooling or energy-efficient investments, there may be additional benefits available. By staying informed about these opportunities and consulting with a tax professional, you can ensure compliance with corporate tax rates while optimizing your financial situation. Remember, understanding these deductions and their eligibility criteria is key to navigating the intricate world of taxes effectively. Find us at profit and loss statement analysis for a detailed breakdown of potential savings.

Efficient tax management requires a proactive approach and careful planning. By organizing financial records, staying updated with tax laws, setting aside funds for taxes in your budget, and strategically utilizing deductions, you can streamline the process and minimize stress. Remember, proactive tax management today is key to financial security tomorrow.

Leave a Reply

You must be logged in to post a comment.