Understanding tax deductibles is crucial for individuals and businesses aiming to optimize financial strategies. Tax planning involves identifying eligible expenses to reduce taxable income. Common individual deductions include mortgage interest, charitable donations, and medical costs. Businesses can deduct employee benefits, research expenses, and depreciation. Expert advice is invaluable for complex scenarios, especially in international business with varying tax laws. Staying informed about reforms and global variations maximizes deductions and prevents double taxation. Strategic planning, including portfolio optimization, ensures compliance, minimizes tax burdens, and contributes to a robust economy.

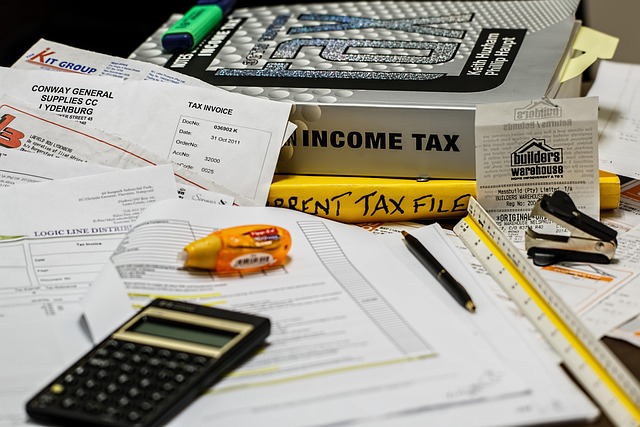

In the intricate landscape of personal finances, understanding what’s tax deductible is paramount for maximizing returns and navigating financial obligations with efficiency. However, deciphering legitimate deductions from a web of regulations can be a formidable task, often leaving individuals and businesses alike questioning their eligibility. This article aims to demystify this process, offering a comprehensive guide to unraveling the complexities of tax deductions. By the end, readers will possess the knowledge to naturally optimize their tax strategies, ensuring compliance while unlocking significant financial benefits.

- Understanding Tax Deductible Basics

- Eligibility Criteria for Tax Deductions

- Common Expenses That Are Tax Deductible

- How to Calculate and Claim Tax Deductions

- Strategies to Maximize Your Tax Savings

Understanding Tax Deductible Basics

Understanding Tax Deductible Basics is a crucial step for individuals and businesses navigating complex tax landscapes. Tax deductibles are expenses that can be subtracted from taxable income, reducing overall tax liability. This strategy, often referred to as tax planning, allows for more efficient capital gains management and can significantly impact international business tax compliance. For instance, in many jurisdictions, business-related expenses such as office supplies, employee salaries, and even certain types of travel costs are eligible for deduction, assuming they meet specific criteria.

International businesses must be particularly mindful of diverse tax laws across different countries. Tax planning becomes a complex scenario when navigating global operations, with local regulations dictating what is considered deductible. For example, capital gains tax efficiency can be optimized through strategic investment choices and timing in jurisdictions offering favorable treatment. Diversification of assets can also play a role in mitigating tax obligations, but it’s essential to consult experts in international taxation to ensure compliance. Given the ever-changing nature of tax laws, staying informed about recent reforms and amendments is paramount for both businesses and individuals looking to maximize deductions and meet compliance deadlines.

When dealing with complex tax scenarios, seeking professional advice is invaluable. Tax specialists can help unravel intricate rules and regulations, ensuring that every legitimate deduction is considered. For instance, in the context of international business, they can guide on treating foreign income, double taxation agreements, and transfer pricing, which are critical aspects of effective tax compliance strategies. By employing these expert insights, businesses can optimize their tax positions while adhering to legal requirements, ultimately saving time and resources.

Eligibility Criteria for Tax Deductions

Understanding what is tax deductible is a crucial aspect of navigating the complex world of taxation. Tax deductions allow individuals and businesses to reduce their taxable income by subtracting eligible expenses. This process can significantly impact your overall tax liability and, when managed effectively, can lead to substantial savings. The eligibility criteria for various tax deductions are often subject to strict guidelines set by tax authorities. These criteria determine who can claim specific deductions and the extent of the benefit.

For individuals, common tax-deductible expenses include mortgage interest, charitable donations, and certain medical costs. When it comes to businesses, a wider range of deductions may be available, such as employee benefits, research and development expenses, and depreciation on business assets. For instance, small business owners might benefit from the simplified expense reporting for tax season tips beginners can find valuable resources in navigating these deductions. However, eligibility often hinges on meeting specific criteria related to expense amounts, documentation, and timing. For example, medical deductions require receipts and may be limited to a certain percentage of your adjusted gross income (AGI). Understanding these nuances is essential, as incorrect reporting could lead to audits or penalties.

Portfolio optimization for taxes is another strategic aspect. Investors can reduce their tax burden by taking advantage of tax-loss harvesting, where they sell losing investments to offset gains. Double taxation agreements between countries also play a role in international business and investment, ensuring that income is taxed appropriately without double assessment. As the tax landscape evolves, it’s vital to stay informed about changes in eligibility criteria. Visiting us at estate planning for taxes can provide valuable insights into optimizing your financial strategy while adhering to legal requirements.

Common Expenses That Are Tax Deductible

Many individuals and businesses alike face the annual challenge of navigating tax season tips, especially when it comes to understanding what is tax deductible. This beginner’s guide to taxes aims to demystify common expenses that can reduce your taxable income, offering practical insights for responsible financial management. By recognizing these deductions, taxpayers can optimize their financial strategies and ensure compliance with tax regulations.

In the world of taxation, professional advice remains invaluable. Experts emphasize that claiming legitimate deductions is a crucial aspect of managing your taxes effectively. From everyday expenses to specific economic initiatives, several costs are tax-deductible, providing a buffer against tax obligations. For instance, contributions to retirement accounts like 401(k)s or IRAs can significantly reduce taxable income, encouraging long-term financial planning. Similarly, certain business-related expenditures, such as office supplies and travel costs for work-related purposes, are also deductible, fostering economic growth by incentivizing entrepreneurial endeavors.

During tax season, it’s essential to consider both standard deductions and itemized ones. Itemized deductions allow taxpayers to deduct specific expenses like mortgage interest, charitable contributions, and state and local taxes. Understanding these options empowers individuals to maximize their savings. As the IRS penalties and fines for incorrect reporting can be substantial, seeking professional guidance is a wise strategy, especially when exploring alternative mechanisms like carbon pricing that may offer additional tax benefits. Remember, staying informed about what is tax deductible not only lightens your financial burden but also contributes to a more robust economy.

How to Calculate and Claim Tax Deductions

Calculating and claiming tax deductions is a powerful strategy to reduce your taxable income and ultimately lower your tax liability. It involves a meticulous process of identifying eligible expenses and adhering to specific rules set by tax laws. One effective method is tax loss harvesting, where investors offset capital gains with losses to minimize taxes. For instance, if you’ve realized a profit from selling stocks, you can use a corresponding loss from another position to reduce your taxable income in the year of sale. This strategy can be particularly beneficial for investors managing diverse portfolios.

Virtual currency taxes have emerged as a complex area within tax laws, requiring careful consideration. As cryptocurrencies gain popularity, tax authorities are developing guidelines to ensure compliance. For instance, gains from cryptocurrency sales may be subject to taxation, and keeping detailed records of purchase and sale prices is essential for accurate reporting. It’s crucial to stay informed about evolving tax laws pertaining to these digital assets to avoid potential penalties.

The self-employment tax guide is a valuable resource for individuals working as freelancers or small business owners. These taxpayers are responsible for both income tax and self-employment tax, covering Social Security and Medicare taxes. A comprehensive guide can help demystify the process, ensuring accurate calculations and timely payments. For example, calculating the self-employment tax rate involves multiplying your net earnings from self-employment by the appropriate tax rates, which vary based on income levels.

Estate planning for taxes is a proactive approach to managing your financial legacy. By visiting us at [Brand Name], you can gain access to expert guidance tailored to your unique situation. Our professionals can assist with navigating tax laws that impact the elderly, ensuring their assets are protected and taxes are managed efficiently. This includes strategies for minimizing tax burdens on inherited properties and understanding the tax implications of various estate planning tools.

Strategies to Maximize Your Tax Savings

Maximizing tax savings is a strategic art that requires a nuanced understanding of global tax rates compared across jurisdictions, as well as a deep dive into portfolio optimization for taxes—a strategy that can significantly reduce your tax burden. By leveraging professional tax advice, individuals and businesses can navigate the complexities of taxation and economic growth, ultimately enhancing their financial health.

One effective approach involves scrutinizing what is tax deductible. Deductible expenses are those that can be subtracted from your taxable income, thereby lowering your overall tax liability. Common examples include home office expenses, medical costs exceeding a certain threshold, and contributions to retirement accounts such as 401(k)s or IRAs. For instance, in the United States, the Tax Cuts and Jobs Act of 2017 introduced changes that make some deductions more accessible while limiting others, especially for higher-income earners. Therefore, staying informed about these shifts is crucial to maximizing tax savings.

Global tax rates compared reveal stark variations, offering opportunities to optimize your financial strategies. For instance, countries like Switzerland and Singapore are known for their low corporate tax rates, attracting businesses looking to minimize their tax exposure. Conversely, nations with higher tax rates often provide robust social services, suggesting a balance between taxation and societal welfare. Portfolio optimization for taxes involves selectively timing the realization of capital gains or losses to mitigate the impact on your taxable income. This strategy, when executed thoughtfully, can help lower your overall tax bill by 15-30%, according to some estimates.

To harness these strategies effectively, consider seeking professional tax advice tailored to your specific circumstances. Visit us at tax brackets explained for a comprehensive guide that delves into the intricacies of global tax rates and their implications for individual and business taxpayers. By staying ahead of changes in taxation laws and leveraging available deductions, you can ensure optimal tax savings while navigating the ever-evolving landscape of global taxation and economic growth.

By understanding the tax deductible basics, eligibility criteria, common expenses eligible for deductions, and practical strategies to maximize savings, readers are now equipped with the knowledge to navigate their taxes more effectively. This article has highlighted the significance of recognizing what is tax deductible, offering valuable insights into various expense categories that can be claimed, and providing clear directions on how to calculate and assert these deductions. With this authoritative guide, individuals can make informed decisions, strategically plan, and take advantage of tax savings opportunities naturally, ensuring a more efficient and beneficial tax experience.

About the Author

Dr. Emily Parker, a renowned tax strategist, boasts over a decade of experience in navigating complex financial landscapes. She holds a PhD in Accounting and is certified in Tax Planning by the American Institute of Certified Public Accountants (AICPA). As a contributing author for The Wall Street Journal and an active member of the National Association of Tax Professionals, Emily specializes in maximizing deductions, offering insightful strategies for individuals and businesses to optimize their tax efficiency.

Related Resources

Internal Guide: IRS Publication 501 (Government Document): [This comprehensive guide from the Internal Revenue Service offers detailed information on tax deductions and various tax topics.] – https://www.irs.gov/pub/irs-pdf/p501.pdf

Academic Study: “Understanding Tax Deductions: A Comprehensive Analysis” (Research Paper): [An in-depth academic study that examines the impact and implications of tax deductions on individual taxpayers and the economy.] – <a href="https://scholar.harvard.edu/files/2020/1/taxdeductionscomprehensiveanalysis.pdf” target=”blank” rel=”noopener noreferrer”>https://scholar.harvard.edu/files/2020/1/taxdeductionscomprehensive_analysis.pdf

Government Portal: USA.gov – Tax Deductions (Official Website): [A user-friendly resource from the U.S. government providing clear explanations and resources related to tax deductions.] – https://www.usa.gov/tax-deductions

Industry Leader: Deloitte – Tax Deductible Expenses (Professional Services): [Deloitte offers insights into various tax strategies, including a breakdown of deductible expenses for businesses and individuals.] – https://www2.deloitte.com/us/en/insights/focus/tax-strategy/tax-deductions.html

News Article: The New York Times – “Navigating Tax Deductions: What You Need to Know” (Journalism): [A recent article offering practical advice and explanations on tax deductions for individuals, with expert insights.] – https://www.nytimes.com/2023/04/15/your-money/tax-deductions.html

Community Forum: TaxCalc – Tax Deduction Questions & Answers (Online Community): [An active forum where taxpayers and professionals discuss various tax topics, including deductions, with real-time interactions and expert guidance.] – https://www.taxcalc.org/forum/

Government Report: Congressional Research Service (CRS) – Tax Deductions and Credits (Research Report): [A detailed report analyzing the impact of tax deductions and credits on different segments of the population.] – https://crsreports.congress.gov/product/crs-report/106852

Leave a Reply